4 Services Cp As Provide To Ensure Financial Compliance

Staying compliant with tax and financial rules is not optional. It protects your money, your business, and your peace of mind. A skilled CPA in Westchester County, NY helps you face these rules with clarity instead of fear. You may worry about missed deductions, late filings, or surprise notices. These worries are common. They often come from trying to manage complex rules alone. A CPA offers four key services that keep your records clean, your reports accurate, and your filings on time. Each service reduces risk. Each service also gives you clear numbers you can trust. You gain support during audits, guidance on changing tax laws, and steady checks on your internal controls. You do not need to guess or hope. You can rely on clear steps that protect you from penalties and protect your reputation.

1. Tax planning that prevents costly mistakes

Tax planning is not only for large companies. It matters for families, small businesses, and anyone with income. You face rules that shift each year. You also face strict deadlines. A CPA studies these changes so you do not carry that burden.

Through tax planning, you and your CPA review three things. You review how you earn money. You review how you spend and save it. You review which rules apply to your life or business. Then you adjust your choices before the year ends, not after.

Key parts of strong tax planning include:

- Estimating your yearly tax so you do not face a sharp bill

- Setting up quarterly payments if you work for yourself

- Choosing the right business structure for your tax goals

- Planning for education costs, retirement, and health costs

You also gain defense against penalties. The IRS explains common penalties for late filing and late payment on its site. A CPA helps you avoid these hits by keeping you ahead of every due date.

2. Accurate bookkeeping and financial records

Accurate records are the backbone of compliance. Without them, you guess. Guessing with taxes or reports leads to errors. Those errors can trigger letters, audits, or fines.

A CPA can set up a simple record system that matches your life or business. You do not need fancy tools. You need clear rules and steady habits. The CPA helps you sort income, track costs, store receipts, and match bank records.

This service often includes:

- Monthly review of income and costs

- Bank and credit card reconciliations

- Clean storage of receipts and key papers

- Preparation of basic financial reports

Accurate bookkeeping protects you in three ways. It supports your tax return. It shows you where your money goes. It gives proof if a tax agency asks questions.

3. Financial reporting that keeps you transparent

Financial reports show the story of your money. They show what you own, what you owe, and how you perform. Lenders, investors, and some regulators depend on these reports. Wrong numbers can damage trust quickly.

A CPA prepares or reviews three core reports:

- Balance sheet

- Income statement

- Cash flow statement

Each report answers a simple question. What do you have? How much do you earn or lose? How does cash move in and out? When these reports are clear and correct, you can make strong choices for your family or business.

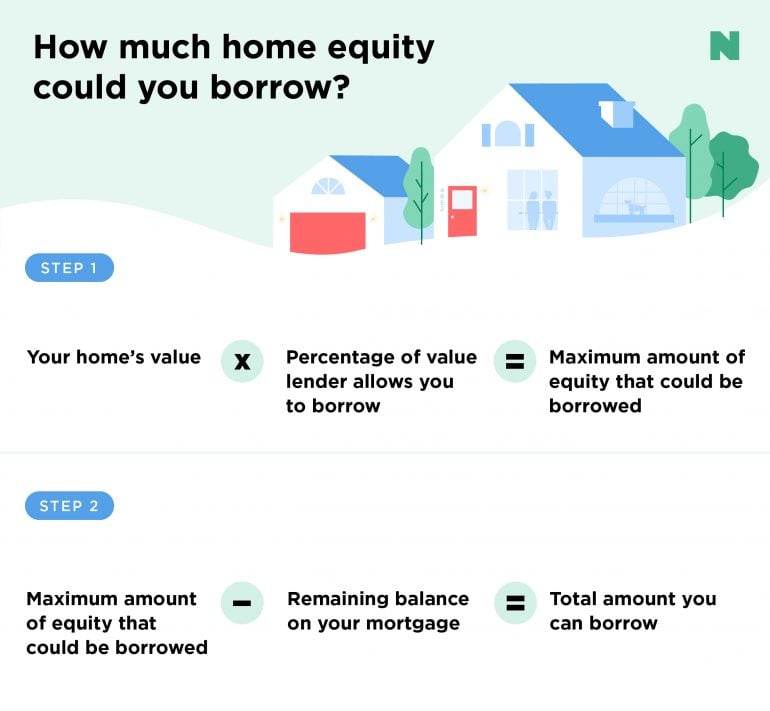

You also gain support if your bank or a state agency asks for proof. Many lenders now expect clean financials before they approve credit or renew a loan. A CPA gives those reports structure so they meet common standards taught by programs such as those at the U.S. Small Business Administration.

4. Audit support and internal control checks

Few things create as much fear as an audit notice. You might fear that you did something wrong. You might fear that you will not understand the questions. A CPA stands between you and that stress.

Audit support includes:

- Review of the notice and your rights

- Collection and sorting of needed records

- Direct contact with the tax agency when allowed

- Clear answers to questions from the auditor

Beyond audits, a CPA reviews your internal controls. These are the checks that protect you from theft, fraud, or simple mistakes. Simple steps, such as separating who handles cash from who records it, can stop loss and support compliance.

How CPA services compare with doing it yourself

You might wonder if you should manage all this alone. Many people try. Some manage for a time. Then a missed form or a small mistake creates pain that lasts for years. The table below shows common differences.

| Task | Do It Yourself | Work With CPA |

|---|---|---|

| Tax planning | Use basic software and guess on rules | Plan around current laws and your goals |

| Record keeping | Scattered receipts and mixed accounts | Structured system and monthly review |

| Compliance risk | Higher chance of missed forms and dates | Lower risk through calendars and checks |

| Audit response | Face questions alone | Guided support and organized proof |

| Time cost | Many nights and weekends on paperwork | More time for family and core work |

How to work with a CPA for stronger compliance

You play a direct role in this partnership. A CPA cannot protect what you hide or forget. You improve results when you:

- Share all tax letters and notices as soon as you receive them

- Use one bank account for business and a separate one for personal use

- Store receipts in one simple place each week

- Ask questions when you do not understand a request

Federal and state rules will keep changing. That reality will not pause for your schedule or stress. With steady support from a CPA, you can face those changes with less fear and more control. You gain clearer choices, cleaner records, and stronger protection for your money and your name.