An Auspicious Beginning: Defining the Business Sale Prospectus

In the world of commerce, a Business Sale Prospectus serves as an essential compass, steering potential buyers towards an informed decision about investing in your business. It is an official document that outlines the financial and operational facets of a company that is up for sale. This prospectus acts as the face of your business to potential buyers, encapsulating both its tangible and intangible aspects.

The term ‘prospectus’ traces its lineage back to Latin roots, where it means ‘view’ or ‘sight.’ It gives apt insight into its purpose – providing a comprehensive view of your business to prospective investors. The intricacies woven into this document include information about the company’s history, current operations, financial health, market position, growth potential and much more.

A meticulously crafted business prospectus offers clear visibility into all these aspects without overwhelming its reader. Moreover, it delineates any risks associated with acquiring this business while presenting a well-rounded profile of the venture’s key players (the management team).

The most compelling prospectuses are those characterized by transparency-they spotlight not only successes but also challenges and how they were surmounted. Thus, creating a robust Business Sale Prospectus is tantamount to laying out an inviting route map that leads potential investors right up to your doorsteps.

The Compass Pointing North: Unraveling the Importance and Purpose of a Business Sale Prospectus

Navigating through the complexities of buying a new enterprise can be daunting for even seasoned businessmen; herein lies the cardinal importance of a detailed Business Sale Prospectus. Acting as an informative handbook for possible buyers or investors,this document can significantly simplify their decision-making process.

Besides offering salient details about your enterprise to interested parties, another crucial purpose serviced by this prospective guide is attracting attention towards your offer from qualified buyers within relevant industries. By keeping your prospectus succinct yet comprehensive, you can spark intrigue while furnishing all vital information required by a potential buyer to make an informed decision.

Furthermore, a Business Sale Prospectus is an integral tool for transparency and trust-building. By presenting an honest picture of your company’s operational and financial health, you are building credibility with the potential buyer.

It underscores your commitment to integrity in business dealings while demonstrating respect for their investment decision. A well-executed prospectus is far more than just a sales pitch; it is the first step towards establishing a relationship anchored in trust and mutual respect with the future owners of your business.

Understanding the Audience for Your Business Sale Prospectus: The Confluence of Interests

Before diving into the intricacies of designing a winning business sale prospectus, it’s crucial to comprehend who your readers are. A business sale prospectus is not an isolated document meant for a singular recipient, rather it caters to a variety of interested parties.

Potential Buyers: The Drive for Detail

Potential buyers do not just buy into your business; they buy into your vision, success story, and future potential. Thus when crafting a prospectus aimed at buyers, meticulous detail is essential. They require comprehensive information about your business operations, profit margins, market position etc., that would aid them in their decision-making process.

In the initial paragraph of any section concerning potential buyers, make it compelling enough to heighten their interest in pursuing further dealings with you. Highlight key financial data and USPs that will entice them towards contemplating ownership transition.

Subsequently dive deeper into matters such as revenue streams and cash flows so they have clear visibility over what they are buying into. Provide reassuring data regarding customer loyalty or long-term contracts which can provide potential buyers with confidence about stabilised future revenue flow thus making your proposition more attractive.

Investors and Financial Institutions: The Search for Solvency

The second group that pays heed to your prospectus are investors and financial institutions like banks or venture capitalists who might be interested in funding the transaction. Their primary focus is on the financial health and profitability of the company.

When addressing this group within your document begin with salient points reflecting strong liquidity ratios or return on investments which would pique their interest by suggesting low risk levels linked to investment within your enterprise. In subsequent paragraphs offer detailed financial analysis – balance sheets, cash flow statements or P&L accounts – which demonstrate sustained profitability over time thus validating their initial interest.

Wrap the section with your vision and future financial performance projections. This offers them an insight into where their funds will be utilised and the expected timeline for optimal returns.

Legal Entities: The Pursuit of Compliance

Legal entities scrutinise your prospectus, seeking full disclosure and compliance with all regulatory requirements. This group includes lawyers, regulatory authorities, and potentially even the court if disputes arise during the transaction process.

Start by showcasing your adherence to past legal compliances such as paying taxes or respecting labour laws. It offers a reassurance of your ethical conduct in business dealings and respect for legal obligations.

Progress into areas like licencing agreements or intellectual property rights if they are relevant to your business. Legal entities keenly observe these areas to avoid potential litigation post change in ownership.

Conclude this segment by emphasising future compliance like anticipated changes in law which could impact your business. Understanding that you are cognizant of such matters can build confidence about smooth transition from a legal perspective.

Components of a Winning Business Sale Prospectus

The Executive Summary: The Business in Brief

The executive summary of a business sale prospectus serves as the first impression and should be designed to captivate potential buyers. This synopsis provides a concise overview of the business, encapsulating its principal attributes.

It should illuminate the organization’s history, its mission, services or products offered, and the markets it serves. Additionally, it is crucial to highlight key selling points that make your business remarkable.

These could include proprietary technology, exclusive contracts, or impeccable customer service reputation. Distinctive aspects that set your firm apart from competitors are significant hooks for possible acquirers.

High-level financial information should be included in this section. Essentials such as gross revenue, net income over recent years and assets owned offer potential investors an insight into the economic health of your company.

Detailed Description: Painting a Comprehensive Picture

A detailed depiction of your business forms the backbone of your prospectus. It begins by recounting the history and evolution of your enterprise – from its inception to its current state – tracing milestones achieved along the way. Next is to outline current structure and operations which involves detailing how various departments interplay for smooth running.

It includes elements like production processes, marketing strategies employed, supply chains management techniques used among others. The market position segment elucidates on where you stand amidst industry competition while outlining unique selling propositions (USPs) that provide strategic advantage over competitors.

Financial Information: The Fiscal Report Card

An in-depth financial analysis provides potential buyers with an insight into past performance and future prospects of your business’ profitability through Profit & Loss statements and balance sheets among others. Additionally include projected financial performance which offers vision into anticipated revenue growth and profitability trends based on well-founded assumptions about market conditions and internal factors like capacity expansion or cost reduction strategies.

Management Team & Employees: The Human Factor

This section illuminates the calibre and experience of the management team, pulling together brief biographies of key team members. It elucidates on their educational background, professional credentials, and significant accomplishments that have contributed to the business’s growth. Moreover, this section should also depict employee structure and roles – how many employees there are, what their functions are – painting a picture of both the leadership and workforce that drive your enterprise.

Market Analysis: Understanding the Battlefield

A market analysis in your prospectus should provide data about size and growth trends of your industry at large. It lays bare opportunities your business is positioned to capitalize on and how you plan to outmaneuver competition or overcome potential threats, thus offering assurance to potential buyers.

SWOT Analysis: A Reality Check

A SWOT analysis (Strengths, Weaknesses, Opportunities & Threats) provides an objective evaluation about where your business currently stands. It underlines inherent strengths and weaknesses within your organization while highlighting external opportunities available for growth alongside threats that may impede progress. By incorporating a comprehensive SWOT analysis into your prospectus, you demonstrate a grounded understanding of both internal operations and broader market dynamics – an attribute revered by investors.

Creating an Attractive Presentation Style for your Prospectus

The Imperative of Professionalism

A business sale prospectus is a document that embodies the professionalism and ethos of your organization. The way it is presented can significantly influence potential buyers’ perception of the business.

A polished, well-structured document suggests a well-run, efficient enterprise, whereas a hastily assembled prospectus might raise doubts about management’s competence. Therefore, it is crucial to ensure that your prospectus exudes professionalism in every facet, from the choice of words to the quality of paper used for printing.

Professionalism extends beyond mere aesthetics; it also encompasses accuracy and comprehensibility. Ensure all financial data and legalities are impeccably presented without errors or ambiguities.

As much as possible, avoid using jargon or highly technical terms that may alienate some readers who may not have extensive industry knowledge. Furthermore, consistency forms a significant part of professionalism.

It enhances readability and comprehension while projecting an image of orderliness and meticulousness which potential investors find appealing. Consistent formatting throughout includes maintaining uniform fonts, headings sizes and styles, bullet types among others.

The Power of Visual Appeal: Using Graphics Effectively

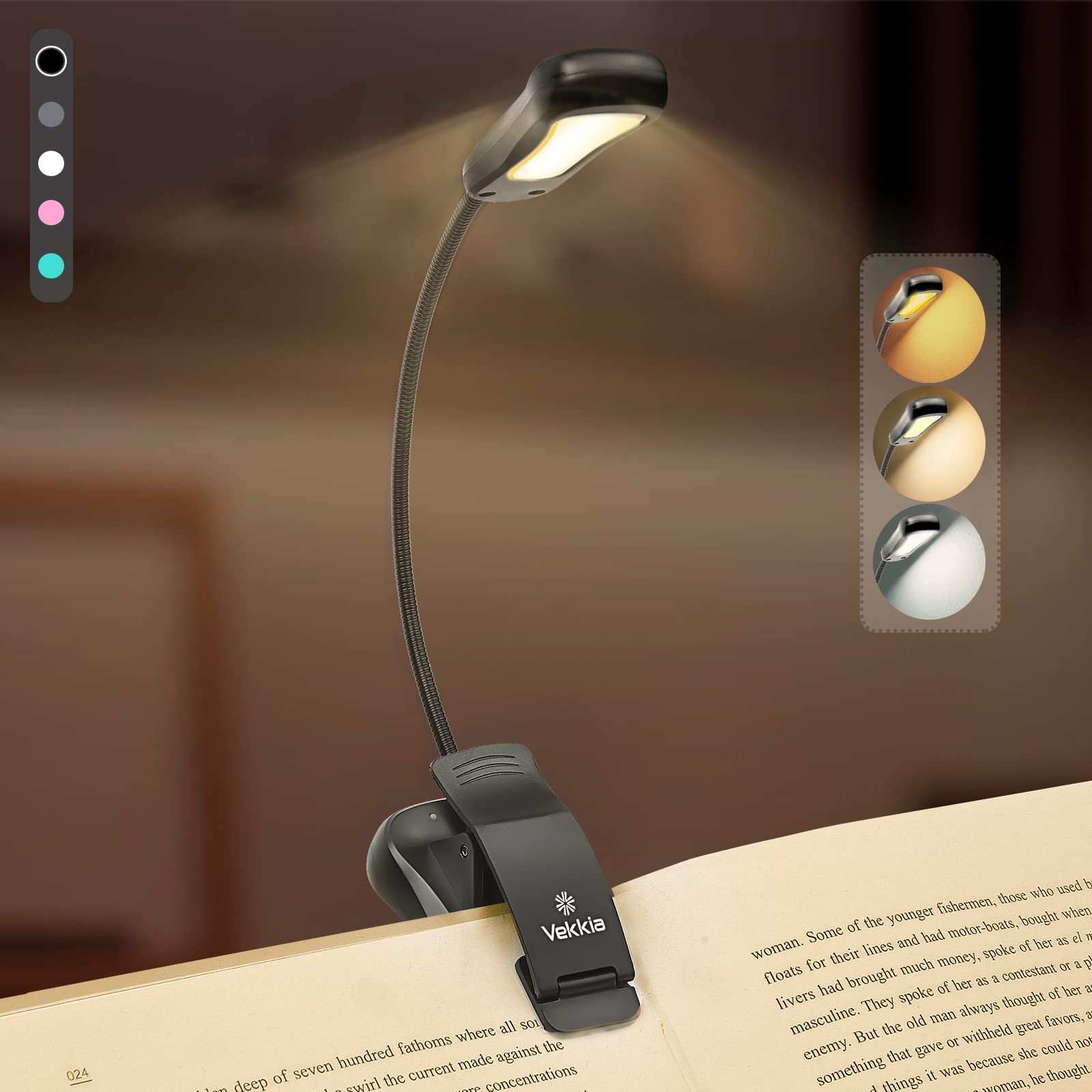

In the realm of business communication, visual elements often serve as potent tools for conveying complex information efficiently. When mentioned in text form alone some details can be overwhelming or difficult to comprehend; graphics rescue such situations by illuminating these complexities in more digestible formats. The strategic use of charts, infographics or diagrams could significantly enhance understanding especially when dealing with voluminous data sets or intricate processes – areas common within financial sections and operational overview respectively.

For instance depicting trends over years via line graphs may be more impactful than just quoting figures sequentially. However caution should be exercised as poorly designed graphics can be just as damaging as none at all.

They should only be used where they add value, not for decorative purposes. Thus each graphic element must have a clear purpose and be well-designed, easily interpretable and neatly integrated into the overall layout of the prospectus.

Information Navigation: The Art of Organization

Organizing information in your prospectus is an art that can greatly influence its effectiveness. An excellently composed prospectus can lose its lustre if readers struggle to locate or follow through the information provided. Hence, careful thought should be devoted to creating a logical flow from one section to another, observing proper sequencing and use of signposts such as subsections, bullet points and headers.

An effective method involves starting with general information then progressively providing more detail; this mimics natural comprehension progression hence offering inherent navigation ease. For instance, the executive summary initially gives an overview before other sections delve deeper into respective facets of your business.

Besides sequential organisation consider adding a table of contents at the beginning and possibly an index at the end for documents expected to exceed twenty pages in length. These tools provide avenues for quick referencing thus improving overall user experience which may indirectly bolster their perception towards your business.

Legal Considerations when Creating a Business Sale Prospectus

Navigating the Disclosure Requirements

In the realm of business sales, transparency isn’t merely a virtue; it’s a legal necessity. The disclosure requirements within a business sale prospectus are designed to provide potential buyers with all pertinent information to make informed investment decisions.

These include not only the positive aspects of the company but also any material facts that could influence an investor’s decision, such as legal disputes, debts, or potential market risks. The level of detail provided must be extensive enough to allow potential investors to grasp the full range of commercial implications associated with acquiring your business.

Failure to disclose certain information could be construed as misrepresentation or fraud which could lead to dire legal consequences. Therefore, it is important that all disclosures are accurate and complete.

To ensure comprehensive disclosure without revealing trade secrets or breaching confidentiality agreements, it may be advisable to utilize Non-Disclosure Agreements (NDAs) with potential buyers. This can protect sensitive company information while meeting disclosure obligations.

Potential Liabilities and Mitigation Strategies

When preparing your business sale prospectus, understanding potential liabilities is crucial for both seller and buyer. Potential liabilities can come in many forms including warranty claims, product liability claims, contract breaches, pending litigation issues or regulatory fines.

These liabilities can significantly impact the valuation of your business and may dissuade prospective buyers if not properly addressed and disclosed in your prospectus. Hence it is beneficial for sellers to perform a thorough internal audit and generate an exhaustive list detailing every possible liability before releasing their prospectus.

In some cases, sellers might consider obtaining liability insurance policies as part of their risk mitigation strategy prior to initiating sales discussions. It’s also worth exploring whether certain liabilities can be settled before beginning negotiations so they do not pose obstacles during transaction talks.

Consulting with Legal Professionals

Crafting a business sale prospectus can be a labyrinthine process replete with legal intricacies. Understanding legal language, technicalities, disclosure requirements, and potential liabilities is no small task. Therefore, it is highly recommended to collaborate with legal professionals experienced in mergers and acquisitions throughout the process.

A legal expert can provide valuable insights into the complex process of creating your prospectus by ensuring all information is presented accurately and without exposing you to unnecessary risks or liabilities. They will help protect your interests while assuring compliance with all necessary regulations.

Legal counsel can also assist in drafting a robust NDA to protect your company’s proprietary information during discussion phases. Furthermore, they can negotiate on your behalf during sales discussions to ensure that you obtain the most beneficial outcome from the transaction.

While creating an effective business sale prospectus requires significant investment of time and energy, it’s crucial that you do not overlook the essentiality of legal adherence. It’s not just about producing a quality document—it’s also about protecting yourself legally and strategically positioning your business for a successful sale.

Conclusion: The Role of the Business Sale Prospectus in Successful Transactions

Unveiling the Tapestry: Recapping the Symphony of a Winning Prospectus

The creation and presentation of a winning Business Sale Prospectus is an artful blend of factual representation, strategic analysis, persuasive narrative, and meticulous detailing. It serves as your ambassador to potential buyers, investors, and financial entities – presenting the past, present, and future prospects of your business in an encapsulated form.

From crafting an engaging executive summary that hooks interest to offering a thorough financial overview demonstrating your business’s robust health – each section plays its role in painting a comprehensive portrait. The Market Analysis and SWOT Analysis sections allow you to demonstrate not only your awareness and understanding of market dynamics but also highlight how your business stands resilient regardless of competition or market challenges.

Management Team & Employees section humanizes your business by introducing its key people while legal considerations underscore the transparency and credibility. In essence, each component contributes to constructing an authentic narrative about your enterprise’s value.

Polishing the Lenses: Honing Precision Through Thoroughness

Creating a successful Business Sale Prospectus demands both broad strokes and fine detailing. Broad strokes capture the panoramic view – reflecting industry trends, target audience insights, or operational scale; meanwhile, fine detailing involves accurate number crunching for financial sections or precise verbiage for describing products/services. Together they ensure that no critical aspect is overlooked or misrepresented.

Thoroughness is crucial not just for completeness but also for establishing credibility with prospective buyers or investors who may conduct due diligence based on provided information. An inaccurate or incomplete representation could lead to lost confidence or potential legal implications which could jeopardize transactions.

A Beacon of Transparency: The Quintessence of Honesty in Your Narrative

At its core though transcending mere facts and figures is honesty – the heartbeat of a winning Business Sale Prospectus. Honesty means presenting the business’s strengths without exaggeration, acknowledging weaknesses without defensiveness, and offering realistic projections instead of inflated promises. This honesty invites trust – a foundation stone in any successful business transaction.

It reassures potential buyers or investors about their decisions’ validity and fosters genuine business relationships. So, let your Business Sale Prospectus be a reflection of your enterprise’s true worth – illuminated by truth and fortified by thoroughness.For business owners and investors looking for verified business-for-sale opportunities and market insights, a dedicated resource can be found at:https://business4sale.co.uk/

Appendices: Supporting Documents to Include with Your Business Sale Prospectus

Unveiling the Significance of Appendices in Your Prospectus

In the anatomy of a meticulously crafted business sale prospectus, the appendices serve as the capstone component, hosting an array of documents that underpin and give credence to your claims. These documents work in unison to offer potential buyers a more comprehensive understanding of your business.

They enable you to substantiate your statements and give readers the confidence needed to proceed with investment or purchase deliberations. The appendices are not just an afterthought; they are integral elements that could potentially tip scales in favor or against a deal.

They can either corroborate your assertions, thus cementing trust between potential buyers and your venture, or expose discrepancies that sow seeds of doubt. Henceforth, it is imperative that every document included is carefully selected for its relevance and verifiability.

Astutely Selecting Documents for Your Appendices

The supporting documents included in your appendices must be meticulously chosen and should reinforce what has been outlined throughout the prospectus. These might include audited financial statements from previous years, copies of contracts with significant suppliers or customers, patents or intellectual property rights held by the business, or even market research data. One might also consider including employee agreements and relevant HR documentation if staff retention is a key element being marketed to potential buyers.

Similarly, if you are highlighting unique processes as part of your Unique Selling Proposition (USP), having pertinent technical manuals at hand can prove beneficial. Remember – information overload can be counterproductive – therefore each inclusion should add value and provide greater clarity about aspects critical to decision making for prospective buyers.

Forestalling Potential Pitfalls – Confidentiality & Relevance

While transparency boosts credibility, caution must be exercised when it comes to maintaining confidentiality. Certain documents may contain sensitive information that you wouldn’t want to disclose too early in the process. In such scenarios, it is advisable to keep a reserve of documents ready for disclosure at the appropriate juncture.

Another pitfall to avoid is irrelevance. Including every document associated with your business can result in an unmanageable and perplexing mass of pages that serve only to obscure important information rather than elucidate it.

Be judicious, be relevant – a well-curated appendix can serve as a powerful testament to your business’s worth. Appendices form a significant part of your business sale prospectus – they are the tangible proof that substantiates your claims, instills confidence in potential buyers, and ultimately aids in ensuring a successful transaction.