Best Strategies for Playing Roulette

Roulette is a classic game. It has been captivating gamblers for centuries. With its spinning wheel and thrilling bets, it’s no wonder that roulette remains a favorite in both brick-and-mortar and online platforms like 999Casino. However, winning at roulette is not solely a game of chance; strategic thinking can significantly improve your odds. In this article, we’ll explore some of the best strategies for playing roulette and maximizing your potential for success.

Understand the Variants

Roulette comes in various versions, with the two most popular being European and American roulette. European roulette has a single zero, but if we talk about American roulette, it has both a single zero and a double zero. The double zero in American roulette increases the house edge, which is why European roulette is generally more favorable among players. Understanding the differences between these variants is the first step toward a winning strategy.

Bet Wisely: Inside vs. Outside Bets

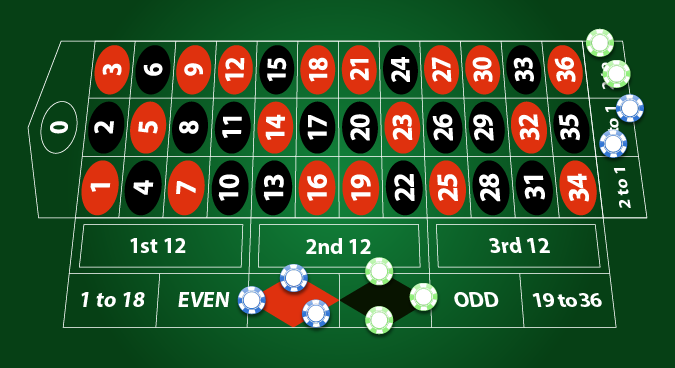

Bets can be categorized into two main types: inside and outside. Inside bets involve betting on specific numbers or small groups of numbers, offering higher payouts but lower odds of winning. However, outside bets cover larger groups of numbers and have lower payouts but higher odds of winning.

If you’re looking for a safer strategy, outside bets like red or black, odd or even, or high or low numbers are ideal. They provide a nearly 50% chance of winning. Inside bets, such as straight bets on a single number, can be riskier but offer substantial payouts when successful. Balancing inside and outside bets based on risk tolerance is a key part of a successful strategy. Also keep in mind that while roulette wins may be large, they are not as massive as those the new slot jackpots offer.

The Martingale System

The Martingale betting system is one of the most famous strategies in roulette. It involves doubling bets after each loss to compensate for previous losses and profit when you eventually win. While the Martingale system is effective in the short term, it carries significant risks, especially if you encounter a losing streak. It’s crucial to set strict betting limits when using this strategy to avoid substantial losses.

The Fibonacci System

The Fibonacci betting system is based on the Fibonacci sequence. In this system, each number is the sum of the previous two. In roulette, this translates into increasing your bet after a loss following the Fibonacci sequence (1, 1, 2, 3, 5, 8, 13, etc.). This system provides a structured approach to managing your bets and mitigating losses. However, like the Martingale system, it’s essential to set limits to avoid chasing losses endlessly.

The D’Alembert System

The D’Alembert betting system is a more conservative approach. It involves increasing the player’s bet by one unit after losing and decreasing by one unit after they win. This method aims to capitalize on “hot” and “cold” streaks, making it less risky than the Martingale or Fibonacci systems. However, it may not lead to substantial profits as quickly.

Practice Bankroll Management

Regardless of the strategy you choose, effective bankroll management is paramount. Set a budget for your sessions and stick to it. Also, you need to avoid chasing losses by increasing your bets recklessly, as this can quickly deplete your funds. Divide your bankroll into smaller sessions and know when to walk away, even if you’re on a winning streak. Many Bitcoin casinos provide automated loss limits so you could use those too!

Enjoy the Game

While strategies can improve your odds, it’s essential not to forget that roulette is ultimately a game of chance. The outcome of each spin is random, and there’s no foolproof way to predict where the ball will land. Approach roulette with the mindset of having fun and enjoying its excitement. Winning is a great thrill, but the entertainment value should always be a primary goal.

Conclusion

Roulette is a game of elegance and chance, and while there is no guaranteed strategy for success, understanding the game’s nuances can improve your odds. Choose European roulette for better odds, balance your inside and outside bets based on your risk tolerance, and consider employing betting systems like the Martingale, Fibonacci, or D’Alembert with caution.

Above all, practice responsible bankroll management and savor the experience of playing roulette. It’s a game that has captured the hearts of gamblers for generations. With the right mindset and strategies, every gambler can multiply their winnings while enjoying the timeless allure of the roulette wheel.