Sophie Turner Net Worth 2023 Age, Biography, Career, Nationality, Height, Weight & More

Sophie Belinda Turner, born on February 21, 1996, in Northampton, England, is a globally recognized actress best known for her role as Sansa Stark in HBO’s epic fantasy television series, “Game of Thrones.” Her portrayal of Sansa from 2011 to 2019 brought her immense fame, critical acclaim, and a Primetime Emmy Award nomination. The daughter of Sally, a nurse, and Andrew Turner, a travel agent, Sophie has risen to prominence not just in acting but also as a fashion icon and mental health advocate.

How Did Sophie Turner Begin Her Acting Career?

Sophie Turner’s journey in the realm of acting started at the tender age of 13. She initially appeared in a television film titled “The Thirteenth Tale” in 2013, marking her entry into the industry. Her feature film debut was made the same year in the psychological thriller “Another Me.” These roles served as stepping stones that led her to her breakthrough role in “Game of Thrones,” where she played Sansa Stark, a character whose transformative arc fascinated viewers worldwide.

What Contributed to Sophie Turner’s Rise to Fame?

Sophie gained international fame largely due to her impeccable performance as Sansa Stark in “Game of Thrones.” The series itself was a commercial and critical success, but Sophie stood out for her character’s complexity and growth. Her performance garnered high acclaim and garnered her four Screen Actors Guild Award nominations for Outstanding Ensemble Performance in a Drama Series. Additionally, she appeared in films like “Barely Lethal” (2015), “X-Men: Apocalypse” (2016) and “X-Men: Dark Phoenix” (2019).

How Much Is Sophie Turner’s Net Worth?

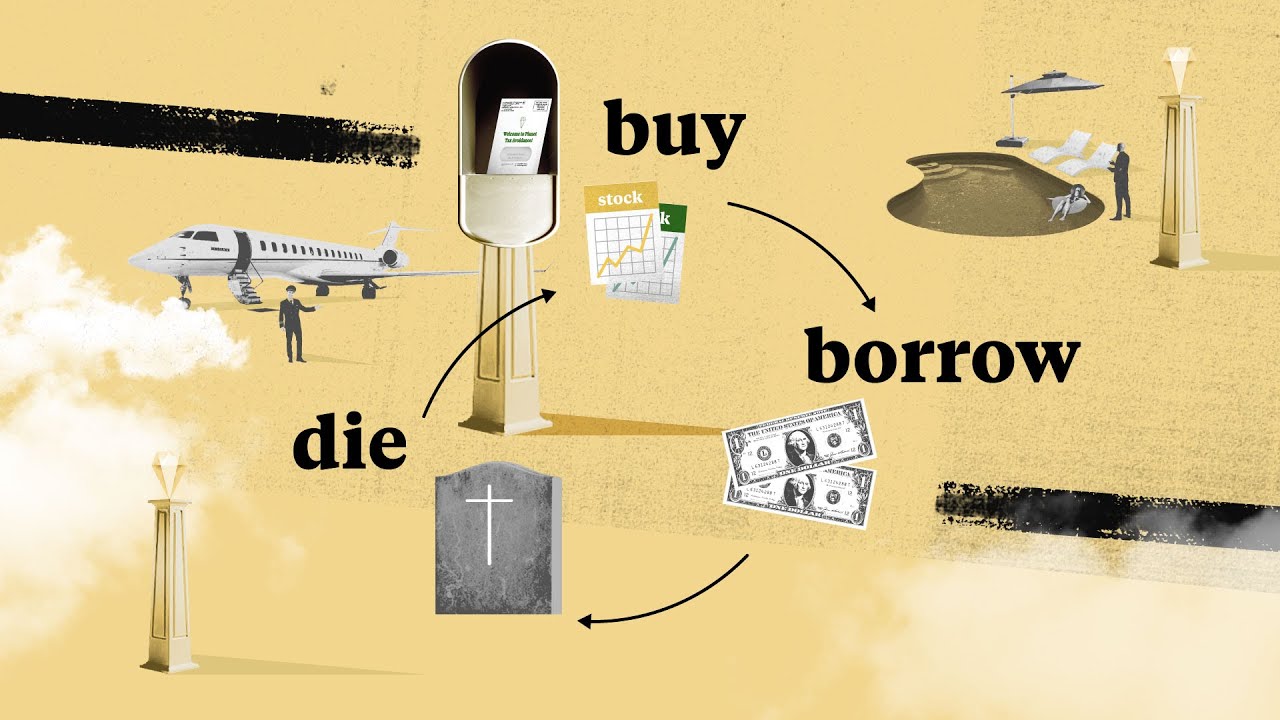

Sophie Turner currently boasts an estimated net worth estimated to exceed $12 Million dollars as of 2023. This impressive financial stature can be attributed to her prolific acting career – particularly her roles in high-grossing films and the most-watched TV show ever, Game of Thrones. Additionally, Sophie lends her image for high-end brands which further contributes to her earnings.

Is Sophie Turner Also a Fashion Icon?

Beyond the camera, Sophie Turner is a name to reckon with in the world of fashion. She has graced various fashion campaigns and has a particular association with renowned brands like Louis Vuitton and Calvin Klein. Her natural elegance and style have made her a go-to muse for top designers, thereby increasing her visibility and influence beyond the acting circuit.

What Is Sophie Turner’s Stance on Mental Health?

Sophie Turner has proven her worth as more than just an attractive face on-screen. Drawing upon personal experiences, she has spoken publicly about anxiety and depression related to her own struggle; by doing this, she hopes to reduce stigma surrounding mental health issues while opening discussions around them.

How Old Is Sophie Turner and What Are Her Physical Stats?

Sophie was born February 21st 1996. As of 2023 she stands at 175 cm which equates to 5 feet 7 inches, and weighs approximately 132 lbs (60 kg). Sophie’s age, height, and weight reflect not just an accurate depiction but reflect how far along in her acting journey she has come.

What Is Sophie Turner’s Nationality?

Sophie Turner is a British national. Born in the East Midlands region of the United Kingdom, she represents the robust British talent in Hollywood. Even as she enjoys global fame, Sophie remains connected to her roots, symbolizing the richness and versatility of British talent in the entertainment industry.

What Does the Future Hold for Sophie Turner’s Career?

Sophie Turner has already accomplished much at such an early age; yet her future looks bright thanks to her exceptional talent, versatility and dedication to her craft. With complex roles coming her way as well as fighting social causes or dominating fashion scenes globally – Sophie will undoubtedly continue captivating audiences worldwide!

Sophie Turner’s multifaceted career is more than an inspiring story of talent meeting opportunity; it also stands as an testament to her dedication, courage, and resilience. One thing remains certain – Sophie Turner will remain an iconic presence for years to come!