Testingamazon Com Scam – Get All the Details You Need Here!

To learn more about the features and legitimacy of Testingamazon.com scam, read exclusive reviews that you won’t find anywhere else.

Investment in domains attracted the attention of the business community, particularly when the cryptocurrency industry faced a decline in 2022 and the stock market and other RoIs became unstable because of Ukraine’s current situation.

In United States and , hundreds of companies offer services that boost domain scores and increase online sales. Did you know some domains are specifically designed to scam their customers? Let’s see what we can find out about Testingamazon.com scam below.

Testingamazon.com –

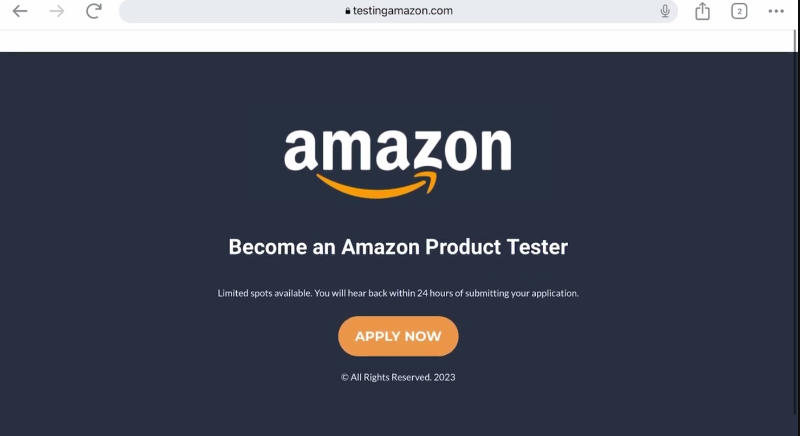

Testingamazon.com is registered in the category of Business Offering – Gift Cards of Reputable Brands. Testingamazon has not yet started its operation. Many people believed that Testingamazon was going to offer Amazon products for test. On the internet are spread several fake images including the Amazon.com logo and the content of Amazon’s product tester.

Its IP 35.202.21.90 was determined to be related to three other domains, including 1pct.io, 21lawsofselflove.com, and 30secondtruths.com. Leadpages(r) is a company that helps new and upcoming startups launch their websites to increase sales. Leadpages offers Testingamazon.con friendly tools that allow you to build an SEO-friendly, smart website. These include Drag-and-drop, Mobile-responsive, Code-free templates, and integration with Google Services like maps.

21lawsofselflove.com, and 30secondtruths.com were inactive. In the meantime, 1pct.io was offering a dotted-puzzle to its users in order to discover rewards for themselves. It is possible that you are aware of popular websites such as CouponBirds.com, which offer Amazon Coupon Codes with 87%+ discount. There are also several websites that offer free Amazon GIFT CERTIFICATES.

It is therefore expected that Testingamazon.com will offer GIFT CARDS as an EXCHANGE for some sort of purchase (or) deal, such as Leadpages. This ultimately aims to BOOST SALES!

Check Testingamazon.com further. Testingamazon.com acts like a domain park, with no specific e-stores or businesses confirming its ownership. Leadpages handled 21lawsofselflove.com as well as 30secondtruths.com. Both sites populate the error message “404 not found”.

It is not clear if Testingamazon.com offers products and services or shuts down. The domain was only registered for one year and seven months have passed.

Why does Testingamazon.com appear to be a scam site?

People suspected the news about Testingamazon.com scam was true because Testingamazon.com didn’t specify its mission and its URL contained terms such as ‘testing’ and ‘amazon.’

Testingamazon has not yet offered any products or services. This will be a surprise in the near future. Testingamazon.com has not performed any activities that could be deemed a scam.

In the past, hundreds websites offered their customers Amazon products to test and provide feedback. These websites misused the personal information, payment and contact details of users. These websites also redirect users to unauthentic third-party e-stores in order to conduct surveys or complete mini-tasks. Customers were lured to buy products by the promise of testing them.

Testingamazon.com scam

Testingamazon.com is registered in Toronto, ON Canada on 16th/September/2022. The last update was made on the same date. It’s 7-months-and-11-days-old. It has a limited lifespan as Testingamazon registration expires in 4 months and 22 days on 16th/September/2023

Amazon.com: Tests and their Legitimacy

trust and 62.3% Testingamazon, on the other hand, achieved a zero Alexa ranking, no Domain Authority, 6% suspect, 11% spam, 1% malware and 18% threat scores.

Testingamazon.com scam

Testingamazon does not have contact information, terms or privacy policies, nor owner’s information. Contact Privacy Inc. Customer# 7151571251 is the only available information for its owner.

Testingamazon does not appear on any blacklists and it uses HTTPS. Its IP 35.202.21.90, however, does not have a valid SSL Certificate.

Conclusion:

Testingamazon.com does not seem to be a scam based on the business scores and trust scores. There were no customer reviews or ratings for Testingamazon.com in social media. Testingamazon.com has received 29 website reviews, and 4 YouTube reviews. These reviews suggest that it is a scam. All 33 Testingamazon.com reviews speculated, however, that Testingamazon.com would offer Amazon products to be tested (which has not been confirmed by Testingamazon.com).

Did you find the reviews on Testingamazon.com informative? Please leave a comment about this Testingamazon.com review.