What Will Be The Competitive Constraints after the 2020 Pandemic?

As the virus swept across the world, we leaped forward to make sense of our situation. We realized that the pandemic will leave a long-term, even subtle impact on our health. The progression of its Farwell will be slow and unraveling.

Understanding this for a fact, we now think ahead of how long-term health concerns will impact other domains of our society. Moving forward we realize that the economy has changed for an extended period than we might have considered.

During the pandemic, we saw a decline in productivity. We saw many enterprises declare bankruptcy or even saw difficulty in adapting to the Covid-19 situation. These were often small and medium enterprises that collapsed.

On the other hand we saw many companies and organizations like competitive intelligence consultants increasing their cash reserves. These were the ones who were well positioned in the market and adapted quickly. Hence they increased their dominance in the market.

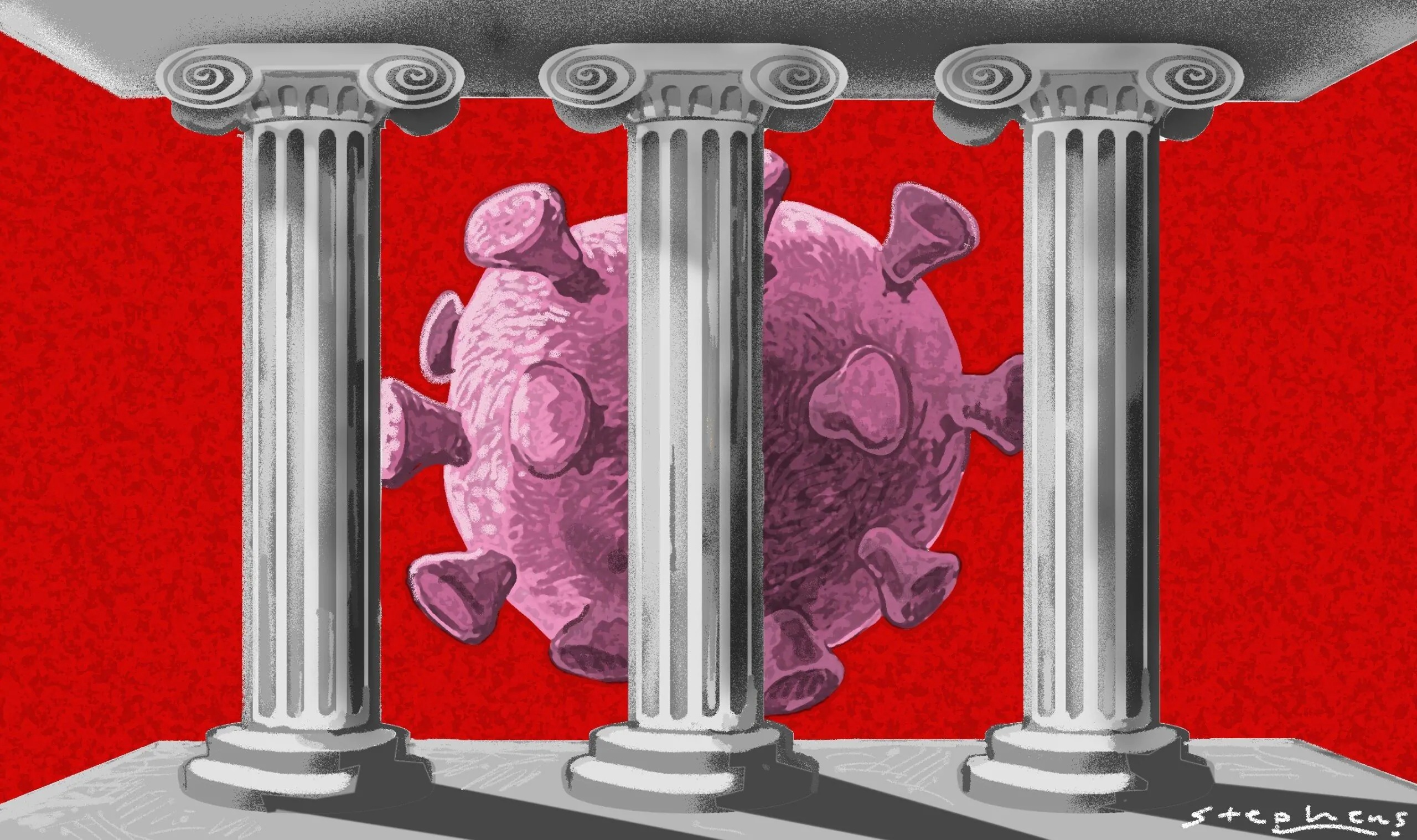

These are 2 different scenarios that came up as the curve thickened and flattened. So this means that competition might as well be another casualty of the Covid-19 pandemic in economies like the United States.

This does prove a great challenge for policymakers to be more assertive in their antitrust enforcement. Ensuring the right intervention to regulate competition and smoothen the economy by having a fair share given to SMEs.

Hence the question arises, What are the competitive constraints after the Covid-19 Pandemic? How much will the market change due to competition? Will it be temporary or permanent?

Arising Dangers to Competition

The increase in the dominance of some firms has made the formation of new businesses unlikely.

Furthermore, employment in new or younger firms has been seen declining. Hence comes the danger that large older firms with less productivity would slow the economic growth down.

The absence of active, innovative younger enterprises means that the speed of growth would decrease. Such enterprises are productive and support the economic machine.

However, to enlist the problems to the competition we must directly talk about what is happening in much detail.

Big getting Bigger

As the pandemic swept across countries, there was a high demand for the tech industry. There was a demand for new tech products, innovative technology that resolves communication gaps and allows tasks to proceed without putting health and lives at risk.

This means that businesses with better networks were able to adapt quickly to social distancing measures. So dominant firms became even more difficult to compete with. There was an increase in the use of social media, streaming services, and online platforms.

This meant that already existing names had a better advantage since they were in more focus. They were able to capitalize on the online, digital market by entering the game with already at advantage.

On the other hand, smaller firms were with poor productivity and use of labor resulting in an overall loss.

Urge to Merge

Companies with large cash reserves were able to take the advantage of assets declining in worth. This meant that some were able to acquire a lot more and the balance was tilted to one side.

The uncertainty during the pandemic has allowed for easy acquisitions to take place resulting in shifting the balance. Firms see this opportunity and have made reserves to take advantage of any possible acquisitions opportunities.

Losing the next generation

Due to the crisis in the business environment, small enterprises and even many larger corporations went into an exit strategy. Declaring bankruptcy, selling assets, reserving their cash. This means that the economy has become more concentrated by large more dominant firms.

Small enterprises don’t really affect the market concentrations much. However, there is a longer, more subtle impact of small enterprises going out on the economy. Small enterprises might not have much impact on concentration but they do have the ability to grow and turn into more competitive and innovative leaders.

This means that in the long run the economy has lost its saturation. One leader dominates comprehensively while it will take time for new competition to rise.

This means that the economy will skip a generation of market leaders.

Development of Cartels

Perhaps the competition that remains may develop into Cartels. As businesses form an alliance with their competitors in order to prevent new competition from entering. Exchange of information and cooperation between competitors and competitive intelligence company would lead to even more solid market domination.

This means that new competitors entering or growing in the market will have a tougher time reaching the top or gaining market share.

Advent of collusions

The chaos that is created in the market will increase the keenness to restore profits. However, this keenness will resort to developing unlawful ways to recover profits. Businesses will try to take advantage of unemployed labor and low competitive prices.

Dealing with Competition and its problems

The collapse in such a situation requires authorities’ attention and resolution. It is up to government bodies and regulating organizations to develop effective solutions for a falling economy.

Government like how the United States announced a 2 trillion dollar bill to credit the economy, needs to input some money into the economic machine. And make sure that it is used in the right areas.

Such as influencing competition so that the market benefits and dissolving concentrations. Antitrust policies need to effectively be put into place. So that competition continues making sure unfair advantage doesn’t take too much out of the competition.

Supporting smaller enterprises to scale up is one way of improving competition. Innovation must not stop and risk-taking ability must be preserved. So that new competition can enter the market and support the economy.

Hence entrepreneurial activity must be promoted and made sure that investments are made into innovative solutions to market problems. Entrepreneurial intentions must be preserved and motivated using clever tactics and organizational support for the entrepreneurs.

Entrepreneurial activity coupled with scaling up capability would resolve long-term market domination of large older firms. The flow of wealth can be managed using interventions and aids.